En la era digital actual, las aplicaciones de finanzas personales se han convertido en una herramienta esencial para gestionar el bienestar financiero. Estas plataformas seguras de finanzas personales ofrecen un sinfín de funciones para ayudar a las personas a controlar sus gastos, establecer presupuestos y planificar su futuro financiero.

Dos actores destacados en este ámbito son Quicken y Menta. Aunque ambas están muy bien consideradas como soluciones fiables de gestión financiera, difieren en varios aspectos que atienden a distintas necesidades de los usuarios.

Mint, una aplicación gratuita de presupuestos desarrollada por Intuit, ha ganado popularidad gracias a su interfaz fácil de usar y a su completo conjunto de funciones. Ofrece a los usuarios una plataforma intuitiva para controlar sus gastos, clasificarlos por categorías y establecer presupuestos realistas.

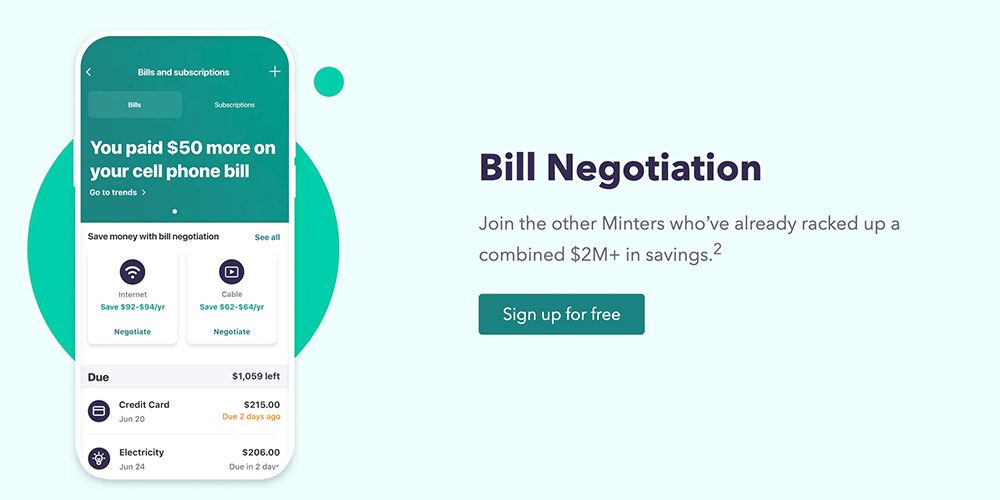

Además, Mint ofrece soluciones de gestión de facturas que permiten a los usuarios recibir recordatorios de los próximos pagos e incluso pagar facturas directamente a través de la aplicación. Con su aplicación móvil de presupuestos disponible en dispositivos iOS y Android, Mint garantiza que los usuarios puedan gestionar sus finanzas sobre la marcha.

Por otro lado, Quicken es famoso por sus sólidas soluciones de presupuestación empresarial y su amplia gama de herramientas financieras. Aunque requiere una cuota de suscripción en comparación con la oferta gratuita de Mint, Quicken ofrece capacidades de planificación financiera mejoradas para particulares que buscan funciones más avanzadas.

Sus potentes herramientas de presupuestación permiten a los usuarios crear planes detallados adaptados a sus circunstancias particulares, al tiempo que ofrecen informes exhaustivos y perspectivas sobre su salud financiera. Un aspecto clave en el que difieren estas dos plataformas es el seguimiento de las inversiones.

Quicken destaca en este ámbito al permitir a los usuarios gestionar carteras, analizar el rendimiento de las inversiones y supervisar las tendencias del mercado, todo dentro de la aplicación. Esta característica lo convierte en la opción ideal para personas centradas en gestión financiera de la jubilación o los que se dedican activamente a actividades de inversión.

La atención al cliente es otra consideración crucial a la hora de evaluar las aplicaciones financieras. Aunque tanto Quicken como Mint ofrecen canales de asistencia al cliente por correo electrónico o teléfono, Quicken destaca por ofrecer un servicio de asistencia dedicado exclusivamente a consultas relacionadas con las finanzas.

A medida que profundicemos en la comparación entre Quicken y Mint a lo largo de este artículo, obtendrás un conocimiento exhaustivo de sus funciones, planes de precios, experiencia de usuario y mucho más. Al examinar los pros y los contras de cada plataforma y analizar los comentarios de los usuarios, estarás preparado para tomar una decisión informada sobre qué aplicación de finanzas personales se adapta mejor a tus necesidades.

Visión general de Quicken

Quicken es un nombre bien establecido y ampliamente reconocido en el ámbito del software de finanzas personales. Como uno de los programas de gestión financiera pioneros, Quicken lleva más de tres décadas al servicio de particulares y empresas. Su longevidad puede atribuirse a sus sólidas funciones, su interfaz intuitiva y su continua innovación.

Una de las principales ventajas de utilizar Quicken es su completo conjunto de funciones. Desde herramientas presupuestarias hasta soluciones de seguimiento de inversiones y gestión de facturas, Quicken ofrece una amplia gama de funcionalidades que satisfacen diferentes necesidades financieras.

Los usuarios pueden crear presupuestos fácilmente, hacer un seguimiento de los gastos y establecer objetivos financieros con precisión. Además, Quicken proporciona informes detallados y perspectivas de sus finanzas, lo que le permite tener una visión clara de su salud financiera.

Quicken también destaca por su versatilidad en la integración de aplicaciones. Se integra a la perfección con varias aplicaciones de presupuestos móviles populares como Mint, lo que permite a los usuarios sincronizar sus datos en múltiples plataformas sin esfuerzo.

Esta integración mejora la comodidad del usuario al proporcionarle una visión consolidada de sus finanzas tanto en el ordenador como en los dispositivos móviles. Además, Quicken ofrece un servicio de atención al cliente específico para los usuarios que puedan tener algún problema o duda sobre las características o funciones del programa.

Dispone de asistencia oportuna a través de diversos canales, como chat en directo, asistencia telefónica e incluso foros específicos en los que los usuarios comparten experiencias y se asesoran mutuamente. Aunque la plataforma de Quicken, repleta de funciones, tiene un coste (con planes de precios adaptados tanto a particulares como a empresas), muchos usuarios consideran que la inversión merece la pena por su carácter integral y sus amplias capacidades.

Sin embargo, las opiniones de los usuarios pueden variar en términos de satisfacción con ciertos aspectos, como los planes de precios o las experiencias de atención al cliente. En comparación con Mint, una aplicación gratuita de presupuestos propiedad de Intuit (la misma empresa que está detrás de QuickBooks), Quicken ofrece claramente funcionalidades más avanzadas adaptadas a diversas situaciones financieras.

Mientras que Mint se centra principalmente en el seguimiento de los gastos y ofrece herramientas básicas de presupuesto con capacidades limitadas de seguimiento de inversiones, Quicken proporciona una plataforma más robusta capaz de manejar escenarios complejos de planificación financiera, incluyendo la gestión financiera de la jubilación y soluciones de presupuesto empresarial. Si buscas una plataforma de finanzas personales segura que ofrezca funciones avanzadas, amplias integraciones de aplicaciones y un completo servicio de atención al cliente, Quicken es una opción excelente.

Se dirige tanto a particulares como a empresas y ofrece una amplia gama de herramientas para gestionar las finanzas con eficacia. Sin embargo, su precio puede no ser adecuado para todo el mundo.

Si buscas una aplicación gratuita de presupuestos con funciones básicas y prefieres la sencillez a las funciones avanzadas, Mint puede ser una opción más adecuada para tus necesidades financieras. Además, Quicken ofrece una rica biblioteca de recursos con amplios materiales de educación financiera para complementar la comprensión de los usuarios de los conceptos y estrategias de finanzas personales.

Visión general de la Casa de la Moneda

Mint, una aplicación gratuita de presupuestos, es una opción popular entre las personas que buscan una plataforma de finanzas personales accesible y fácil de usar. Con su interfaz intuitiva y sus completas herramientas de presupuestación, Mint se ha ganado un público fiel de usuarios que buscan gestionar eficazmente sus finanzas.

Una de las principales ventajas de Mint es su enfoque en proporcionar recursos de educación financiera para ayudar a los usuarios a tomar decisiones informadas sobre su dinero. Cuando se trata de atención al cliente en aplicaciones financieras, Mint destaca por ofrecer varios canales de asistencia.

Los usuarios pueden acceder a una completa sección de preguntas frecuentes, recibir asistencia por correo electrónico o participar en los foros de finanzas personales. Este nivel de asistencia garantiza que los usuarios tengan acceso a los recursos que necesitan para navegar por los entresijos del software de gestión financiera.

La característica más destacada de Mint son sus herramientas presupuestarias. La aplicación permite a los usuarios establecer presupuestos basados en categorías específicas y realizar un seguimiento de sus gastos en función de estos objetivos.

Gracias a la categorización automática de las transacciones y a las actualizaciones periódicas de las tendencias de gasto, Mint permite a las personas controlar sus finanzas fácilmente. Además, Mint proporciona sugerencias para ahorrar dinero en función de los patrones de gasto y ofrece recomendaciones personalizadas sobre ofertas de tarjetas de crédito o cuentas de ahorro.

Aunque Mint ofrece sólidas funciones de seguimiento presupuestario y recursos de educación financiera, puede quedarse corto en comparación con Quicken en determinadas áreas, como el seguimiento de inversiones o las soluciones presupuestarias para empresas. Sin embargo, para las personas que priorizan la simplicidad y la accesibilidad en sus necesidades de gestión de las finanzas personales, Mint sigue siendo una excelente opción debido a su interfaz fácil de usar y amplias capacidades presupuestarias.

Las opiniones de los usuarios de Mint suelen destacar su facilidad de uso y su eficacia a la hora de proporcionar información en tiempo real sobre la salud financiera de cada uno. Muchos aprecian cómo la aplicación simplifica el proceso de seguimiento de los gastos y la creación de presupuestos al tiempo que ofrece valiosos informes financieros y puntos de vista.

Mint es una plataforma segura de finanzas personales que ofrece una serie de herramientas presupuestarias gratuitas, junto con recursos educativos para los usuarios que buscan una gestión eficaz de sus finanzas. Aunque puede que no ofrezca todas las funciones avanzadas de Quicken o que no esté orientada específicamente a la elaboración de presupuestos empresariales o al seguimiento de inversiones, su interfaz fácil de usar y sus completas herramientas presupuestarias la convierten en una de las mejores opciones para quienes desean controlar sus finanzas personales.

Comparación detallada

Al comparar Quicken y Mint, es esencial profundizar en los detalles de cada plataforma para determinar cuál se adapta mejor a sus necesidades financieras.

Tanto Quicken como Mint son aplicaciones de finanzas personales de renombre con sus propias características y ventajas. En esta comparativa en profundidad, exploraremos varios aspectos, como el precio, la interfaz de usuario, las herramientas presupuestarias, el seguimiento de las inversiones, las soluciones de gestión de facturas, los informes y las perspectivas, las medidas de seguridad implementadas por ambas plataformas, la disponibilidad del servicio de atención al cliente y la integración con otras aplicaciones/servicios.

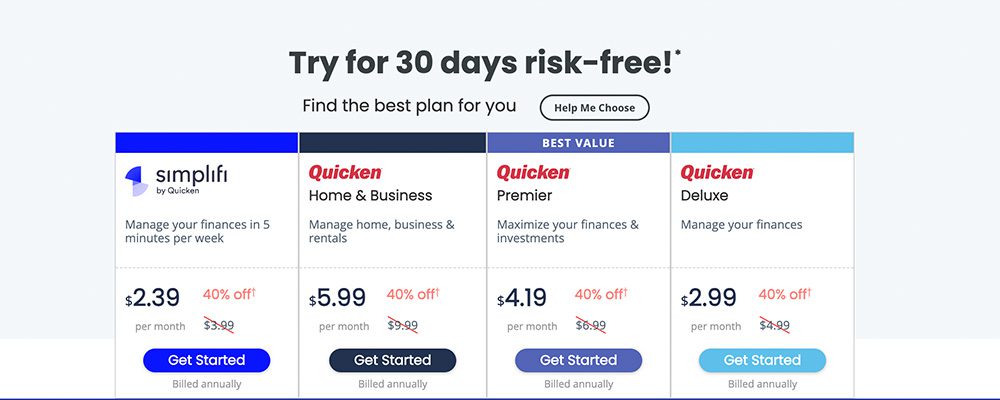

Precios: Quicken ofrece tres planes de precios: Starter ($35,99/año), Deluxe ($51,99/año) y Premier ($77,99/año).

El plan Starter proporciona herramientas presupuestarias básicas y acceso a informes y datos financieros. El plan Deluxe incluye funciones mejoradas, como la creación de presupuestos personalizados y el seguimiento de las inversiones.

El plan Premier añade funciones avanzadas de seguimiento de inversiones junto con un servicio de atención al cliente prioritario. Por otro lado, Mint es de uso gratuito para todos los usuarios.

Genera ingresos a través de publicidad selectiva basada en el análisis de los datos de los usuarios. Si bien esto hace que Mint sea una opción atractiva para las personas conscientes de los costos que buscan herramientas básicas de gestión financiera en el marco de una aplicación de presupuesto móvil, algunos usuarios pueden preferir las características adicionales que se ofrecen en los planes de pago de Quicken.

Interfaz de usuario: Quicken cuenta con una sofisticada interfaz de usuario que atrae a aquellos que dan prioridad a un aspecto profesional con una funcionalidad completa.

Su aplicación de escritorio proporciona una visión global de tus finanzas a través de intuitivos paneles de navegación que permiten acceder fácilmente a distintas secciones, como las herramientas de elaboración de presupuestos o el seguimiento de inversiones. La interfaz de usuario de Mint hace hincapié en la sencillez sin renunciar a la funcionalidad.

Diseñado principalmente para su uso en móviles, pero también accesible a través de navegadores de escritorio, su diseño limpio hace que sea fácil de navegar en cualquier dispositivo sin abrumar a los usuarios con una abundancia de opciones o pantallas desordenadas. Herramientas presupuestarias:

Quicken destaca por ofrecer sólidas herramientas presupuestarias adecuadas tanto para la gestión de las finanzas personales como para soluciones presupuestarias empresariales. Su enfoque basado en categorías permite a los usuarios realizar un seguimiento preciso de los ingresos y gastos, al tiempo que establecen límites presupuestarios específicos.

Además, las alertas y recordatorios proactivos de Quicken garantizan que los usuarios se mantengan al tanto de sus compromisos financieros. Las herramientas presupuestarias de Mint se centran en ayudar a las personas a alcanzar sus objetivos financieros, proporcionando una visión global de todas las transacciones y cuentas en un solo lugar.

Clasifica automáticamente los gastos, lo que facilita a los usuarios la identificación de las áreas en las que pueden recortar o asignar más fondos. Sin embargo, Mint no ofrece el mismo nivel de personalización o funciones avanzadas que Quicken.

Aunque tanto Quicken como Mint son aplicaciones de finanzas personales muy populares, responden a necesidades diferentes. Quicken ofrece sofisticadas herramientas presupuestarias, informes y perspectivas financieras, funciones de seguimiento de inversiones y un servicio de atención al cliente especializado con sus planes de pago.

Por otro lado, Mint proporciona una alternativa gratuita que prioriza la simplicidad y la accesibilidad con su interfaz de aplicación de presupuesto móvil. Comprender tus objetivos y prioridades financieras te ayudará a determinar qué plataforma es la más adecuada para gestionar tus finanzas personales con eficacia.

Precios

A la hora de elegir una aplicación de finanzas personales, el precio suele ser un factor clave. El coste de utilizar un software de gestión financiera puede variar enormemente, y conocer los planes de precios es esencial para tomar una decisión informada. En el caso de Quicken frente a Mint, ambas plataformas ofrecen diferentes modelos de precios adaptados a las necesidades de sus usuarios.

Quicken, conocido por su amplia gama de funciones y sus sólidas herramientas presupuestarias, ofrece varios planes de precios para adaptarse a las necesidades individuales. Su modelo de suscripción incluye tres niveles: Starter, Deluxe y Premier.

El plan Starter es la opción más asequible, con funciones presupuestarias básicas y funciones limitadas de seguimiento de las inversiones. El plan Deluxe lo amplía con herramientas presupuestarias adicionales y funciones de seguimiento de las inversiones.

El plan Premier ofrece amplias funciones de gestión patrimonial, como análisis de carteras y planificación fiscal. Por otro lado, Mint adopta un enfoque diferente al ofrecer sus servicios como una aplicación de presupuestos gratuita.

Esto la convierte instantáneamente en una opción atractiva para quienes buscan soluciones de finanzas personales sin gastar dinero por adelantado. Mint genera ingresos proporcionando recomendaciones personalizadas basadas en los datos financieros de los usuarios y ofreciendo oportunidades para que los usuarios se suscriban a diversos productos o servicios financieros.

Mientras que los planes de precios de Quicken ofrecen funciones avanzadas que son particularmente beneficiosas para las personas que requieren herramientas detalladas de planificación financiera o tienen carteras de inversión complejas, la plataforma gratuita de Mint atrae a aquellos que buscan la simplicidad en la gestión de sus finanzas personales. Vale la pena señalar que, aunque Mint puede carecer de algunas de las características avanzadas que se encuentran en los planes de nivel superior de Quicken, lo compensa proporcionando acceso a una serie de recursos de educación financiera y la integración con otras aplicaciones / servicios.

Los usuarios de Quicken aprecian la amplia gama de funciones disponibles en sus planes de suscripción, pero a menudo expresan su preocupación por los elevados niveles de precios en comparación con otras alternativas. Por otro lado, Mint recibe elogios por ser una plataforma de finanzas personales segura que ofrece una experiencia de usuario intuitiva sin coste alguno.

En última instancia, al considerar el precio entre Quicken y Mint, las personas deben evaluar sus necesidades de finanzas personales, la complejidad de su situación financiera y cuánto están dispuestos a invertir en una herramienta de gestión financiera robusta. Ya sea optando por las completas funciones de Quicken o beneficiándose de la plataforma gratuita de Mint, ambas opciones se adaptan a diferentes usuarios con distintas preferencias en la elaboración de presupuestos y la planificación financiera.

Interfaz de usuario

En cuanto a la interfaz de usuario, tanto Quicken como Mint ofrecen diseños intuitivos y fáciles de usar que se adaptan a personas con distintos niveles de conocimientos financieros. Mint adopta un enfoque más minimalista, con un diseño limpio y elegante que hace hincapié en la simplicidad. El panel de control ofrece una visión global de tu situación financiera, mostrando los saldos de las cuentas, las próximas facturas y sugerencias de presupuestos personalizados.

Navegar por la aplicación no supone ningún esfuerzo, ya que las distintas funciones están perfectamente organizadas en sus respectivas pestañas. Por otro lado, Quicken ofrece una interfaz de usuario más robusta que abastece a los usuarios que requieren un análisis y una gestión financiera en profundidad.

Con su amplio conjunto de funciones, Quicken proporciona a los usuarios una gran cantidad de información al alcance de la mano. La pantalla de inicio ofrece una visión general de su situación financiera, al tiempo que permite un fácil acceso a funciones como herramientas de presupuesto, seguimiento de inversiones, soluciones de gestión de facturas y funciones de generación de informes.

Los menús de navegación están estructurados de forma lógica, lo que facilita a los usuarios encontrar lo que necesitan. En términos visuales y estéticos, ambas plataformas emplean esquemas de color agradables y utilizan tablas y gráficos de forma eficaz para presentar los datos en un formato fácilmente digerible.

Además, la aplicación móvil de Mint ofrece una experiencia fluida en diferentes dispositivos gracias a su diseño responsive. Los comentarios de los usuarios de Mint a menudo elogian la interfaz intuitiva de la plataforma para simplificar las tareas de gestión de las finanzas personales.

Muchos usuarios aprecian lo fácil que es configurar presupuestos en cuestión de minutos con la aplicación gratuita de presupuestos de Mint. La interfaz de Quicken recibe elogios de quienes buscan un conjunto más completo de herramientas para la planificación financiera.

Los usuarios aprecian la posibilidad de personalizar sus cuadros de mando según sus necesidades y preferencias específicas. En general, mientras que Mint destaca por ofrecer una experiencia de usuario sin esfuerzo, especialmente adecuada para principiantes o para quienes buscan una solución gratuita de presupuestación integrada con cuentas de finanzas personales de forma segura; Quicken proporciona a las personas que buscan funciones avanzadas, como el seguimiento de inversiones o capacidades de elaboración de informes más sólidas, un mayor control sobre sus finanzas a través de su plataforma repleta de funciones.

Herramientas presupuestarias

Cuando se trata de herramientas presupuestarias, tanto Quicken como Mint ofrecen una serie de funciones para ayudar a los usuarios a gestionar sus finanzas de forma eficaz. Quicken, conocido por su completo software de gestión financiera, proporciona a los usuarios sólidas funciones de presupuestación que permiten un fácil seguimiento de los ingresos y gastos.

Con las herramientas de presupuestación de Quicken, las personas pueden crear presupuestos personalizados basados en categorías específicas como comestibles, ocio o transporte. Este nivel de personalización permite a los usuarios tener una visión clara de sus patrones de gasto e identificar las áreas en las que necesitan hacer ajustes.

Por otro lado, Mint ofrece una interfaz fácil de usar con funciones de presupuesto intuitivas que se adaptan más a las personas que buscan una forma sencilla y sin complicaciones de realizar un seguimiento de sus gastos. Una característica destacada de Mint es su capacidad para categorizar automáticamente las transacciones de varias cuentas en categorías predefinidas, tales como alimentos, servicios públicos, o salir a cenar.

Esta automatización ahorra a los usuarios tiempo y esfuerzo en asignar manualmente categorías a cada transacción. Además, Mint proporciona a los usuarios actualizaciones en tiempo real sobre sus hábitos de gasto a través de útiles tablas y gráficos que representan visualmente sus datos financieros.

Sin embargo, es importante tener en cuenta que, mientras que Mint ofrece una experiencia de aplicación de presupuesto gratuita para los usuarios, Quicken tiene un coste con sus planes de precios. La ventaja de pagar por Quicken es el acceso a herramientas presupuestarias más avanzadas adaptadas a necesidades específicas, como las soluciones presupuestarias para empresas o la gestión financiera de la jubilación.

Además, Quicken también proporciona informes financieros detallados y perspectivas que permiten a las personas o empresas analizar sus finanzas de forma más exhaustiva. Tanto Quicken como Mint ofrecen valiosas herramientas de presupuestación de diferentes maneras, que satisfacen las necesidades de diversas personas que buscan plataformas de finanzas personales seguras.

Mientras que Quicken puede considerarse más adecuado para quienes necesitan funciones avanzadas, como el seguimiento de inversiones o la planificación de la jubilación, a un precio asequible, Mint es una opción excelente para principiantes o para quienes dan prioridad a la sencillez y la facilidad de uso de las aplicaciones de finanzas personales. En última instancia, la decisión entre Quicken y Mint depende de las preferencias personales, los objetivos financieros y el nivel de detalle necesario para gestionar el presupuesto.

Seguimiento de las inversiones

Uno de los aspectos clave que ofrecen tanto Quicken como Mint es el seguimiento de las inversiones. Ambas plataformas proporcionan a los usuarios herramientas para supervisar y gestionar sus inversiones, lo que permite a las personas mantenerse al día sobre el rendimiento de sus carteras.

Sin embargo, existen algunas diferencias notables en la forma en que estas plataformas abordan el seguimiento de las inversiones. Quicken, conocida por sus sólidas capacidades de gestión financiera, ofrece completas funciones de seguimiento de inversiones.

Los usuarios pueden vincular sus cuentas de corretaje a Quicken e importar toda la información relevante relacionada con sus inversiones. Esto incluye detalles como tenencias de acciones, fondos de inversión, bonos y otros activos de inversión.

Quicken proporciona actualizaciones en tiempo real del valor de estas inversiones, lo que permite a los usuarios tener una visión holística del rendimiento de su cartera. Además, Quicken ofrece herramientas avanzadas para analizar los datos de inversión, generando informes financieros y perspectivas que pueden ayudar en la toma de decisiones.

Por otro lado, Mint también incluye funciones básicas de seguimiento de inversiones. Los usuarios pueden conectar sus cuentas de inversión a Mint y ver un resumen de sus tenencias y el valor de su cartera.

Sin embargo, es importante tener en cuenta que las capacidades de seguimiento de inversiones de Mint son más limitadas en comparación con Quicken. La plataforma no proporciona tantos análisis detallados ni informes personalizables específicamente adaptados a las inversiones.

Si es usted una persona muy dedicada a la inversión o tiene una cartera compleja con varios tipos de activos, Quicken puede ser la mejor opción para usted. Sus amplias funciones y herramientas analíticas se adaptan bien a las personas que buscan análisis en profundidad y opciones de generación de informes para sus inversiones.

Sin embargo, si tienes una estrategia de inversión más simple o prefieres un enfoque más racionalizado sin sacrificar funcionalidades clave como herramientas de presupuesto o gestión de facturas dentro de tu aplicación de finanzas personales, entonces el seguimiento básico de inversiones de Mint puede ser suficiente para tus necesidades. En última instancia, cuando se trata de elegir entre Quicken y Mint para fines de seguimiento de inversiones, es crucial comprender sus necesidades específicas como inversor.

Tenga en cuenta factores como la complejidad de su cartera, el nivel de detalle deseado en los informes financieros y la información disponible en cada plataforma, la facilidad de uso y sus objetivos generales de gestión financiera. Explorar foros de finanzas personales o leer opiniones de usuarios de ambas plataformas también puede aportar información valiosa de usuarios reales que han utilizado estas herramientas para el seguimiento de sus inversiones.

Gestión de facturas

es un aspecto esencial de las finanzas personales, y tanto Quicken como Mint ofrecen funciones para ayudar a los usuarios a estar al tanto de sus facturas. Mint, al ser una aplicación gratuita de presupuestos, ofrece herramientas básicas de gestión de facturas que permiten a los usuarios hacer un seguimiento de las fechas de vencimiento, establecer recordatorios y recibir notificaciones cuando las facturas vencen. También ofrece la opción de vincular cuentas bancarias y tarjetas de crédito, lo que ayuda a hacer un seguimiento automático de los pagos de facturas.

Además, la interfaz fácil de usar de Mint facilita a los usuarios la navegación por las distintas funciones de gestión de facturas. Por otro lado, Quicken ofrece funciones de gestión de facturas más sólidas como parte de su completo software de gestión financiera.

Con los distintos planes de precios de Quicken, las opciones superiores incluyen funciones avanzadas de pago de facturas. Los usuarios pueden configurar el pago de facturas en línea directamente a través de Quicken y programar pagos recurrentes para facturas periódicas como los servicios públicos o el alquiler.

Además, la integración de Quicken con las entidades financieras permite sincronizar automáticamente las transacciones relacionadas con el pago de facturas. Aunque ambas plataformas ofrecen herramientas para la gestión de facturas, existen algunas diferencias notables entre ellas.

El punto fuerte de Mint es su sencillez y comodidad como aplicación gratuita de presupuestos; sin embargo, puede que no sea ideal para personas con situaciones financieras complejas o para quienes necesiten soluciones de presupuestos empresariales. Por otro lado, Quicken ofrece un conjunto más completo de funciones adaptadas a la planificación financiera detallada de los particulares.

En general, los comentarios de los usuarios sugieren que Quicken sobresale en términos de sus capacidades de gestión de facturas en comparación con Mint. Los usuarios aprecian cómo Quicken consolida todas sus facturas en un solo lugar al tiempo que proporciona recordatorios oportunos y garantiza que los pagos se realicen puntualmente.

Además, la posibilidad de personalizar la configuración de los pagos y hacer un seguimiento del historial de transacciones añade un nivel adicional de control y organización. En lo que respecta a las herramientas de gestión de facturas que ofrece Quicken frente a Mint, en última instancia depende de las necesidades y preferencias individuales.

Mientras que Mint ofrece una funcionalidad básica adecuada para la mayoría de los usuarios que buscan una aplicación gratuita de presupuestos con funciones generales de seguimiento de facturas, Quicken va más allá con sus funciones avanzadas de pago de facturas y su integración con entidades financieras. Es importante tener en cuenta los requisitos específicos de la gestión de facturas, así como otras características como el seguimiento de inversiones, las herramientas presupuestarias y la atención al cliente, a la hora de elegir entre estas dos plataformas.

Informes e información

Un aspecto crucial de la gestión de las finanzas personales es la capacidad de generar informes completos y perspicaces.

Tanto Quicken como Mint ofrecen sólidas funciones de generación de informes que permiten a los usuarios obtener información valiosa sobre su salud financiera. Quicken, conocido por su amplia gama de funciones, ofrece a los usuarios diversas opciones de generación de informes.

Los usuarios pueden generar informes sobre ingresos y gastos, rendimiento de las inversiones, patrimonio neto, flujo de caja y mucho más. Estos informes pueden personalizarse con filtros como intervalo de fechas, tipo de cuenta y categoría para ofrecer un análisis detallado de sus datos financieros.

Quicken también ofrece herramientas de previsión que ayudan a los usuarios a planificar los gastos futuros y a tomar decisiones financieras con conocimiento de causa. Por otro lado, Mint se centra en la simplicidad y la facilidad de uso a la hora de elaborar informes.

Aunque puede que no ofrezca tantas opciones de personalización de informes como Quicken, Mint destaca por ofrecer visualizaciones claras de tus datos financieros. La plataforma clasifica automáticamente tus transacciones en categorías predefinidas como comestibles, transporte o entretenimiento.

A través de su intuitiva interfaz, puede ver fácilmente las tendencias de gasto a lo largo del tiempo o comparar su situación financiera actual con la de meses o años anteriores. Ambas plataformas permiten a los usuarios exportar sus informes en diversos formatos, como PDF o Excel, para su posterior análisis si fuera necesario.

Sin embargo, cabe destacar que las funciones de generación de informes de Quicken son más avanzadas y están pensadas para personas que necesitan un análisis en profundidad con fines de planificación financiera. En lo que se refiere a informes e información en aplicaciones de finanzas personales como Quicken o Mint, ambas tienen sus puntos fuertes.

Mientras que Quicken ofrece una gama más amplia de informes personalizables adecuados para análisis detallados y necesidades de planificación financiera a largo plazo, como estrategias de jubilación o seguimiento de inversiones; Mint se centra en presentar imágenes claras que faciliten a los usuarios ocasionales comprender rápidamente su situación financiera general. En última instancia, la elección entre estas dos plataformas depende de las preferencias individuales en cuanto al nivel de detalle requerido en la experiencia del software de gestión de finanzas personales.

Seguridad

Cuando se trata de gestionar las finanzas personales, la seguridad es de vital importancia. Tanto Quicken como Mint reconocen la importancia de salvaguardar la información financiera de sus usuarios, aunque con enfoques ligeramente diferentes. Mint, al ser una aplicación gratuita de presupuestos propiedad de Intuit (la misma empresa que está detrás de TurboTax y QuickBooks), aprovecha su amplia experiencia en seguridad de software financiero.

Mint emplea un cifrado de nivel bancario para proteger los datos del usuario durante la transmisión y mientras están almacenados en sus servidores. Además, Mint ofrece opciones de autenticación multifactor para mejorar la seguridad del inicio de sesión.

Esto garantiza que sólo las personas autorizadas puedan acceder a la aplicación. Quicken, por su parte, ofrece una gama más completa de funciones de seguridad debido a sus planes de precios y a que se centra en la planificación financiera para particulares, así como en soluciones presupuestarias para empresas.

Para garantizar la seguridad de la gestión de las finanzas personales, Quicken se integra con varios bancos e instituciones financieras de renombre que utilizan protocolos de cifrado robustos como SSL/TLS. Además, Quicken ha implementado cortafuegos y sistemas de detección de intrusos para frustrar los intentos de acceso no autorizado.

Los usuarios también pueden activar la protección por contraseña dentro de la propia aplicación para una capa adicional de seguridad. Ambas plataformas priorizan la privacidad del usuario adhiriéndose a estrictas políticas de privacidad que restringen el intercambio de información personal con terceros sin consentimiento explícito.

Sin embargo, cabe señalar que Mint genera ingresos a través de anuncios específicos basados en los patrones de gasto de los usuarios, mientras que Quicken depende principalmente de sus ventas de software. En cuanto a la atención al cliente de las aplicaciones financieras, tanto Mint como Quicken ofrecen asistencia por correo electrónico o chat online.

Además, ofrecen amplios recursos en línea, como secciones de preguntas frecuentes y tutoriales en vídeo para los usuarios que buscan opciones de autoayuda o recursos de educación financiera. En general, aunque ambas plataformas dan prioridad a la protección de los datos del usuario a través de fuertes medidas de encriptación y estrictas políticas de privacidad, los planes de precios de Quicken proporcionan capas adicionales de características de seguridad en comparación con la aplicación gratuita de presupuestos ofrecida por Mint.

Sin embargo, los usuarios que priorizan la simplicidad y las necesidades básicas de gestión financiera pueden encontrar que la plataforma segura de Mint es suficiente para sus necesidades. (Nota: Frases utilizadas: aplicación gratuita de presupuesto, seguimiento de inversiones, planificación financiera para particulares, pros y contras de Mint, planes de precios de Quicken, pros y contras de Quicken, herramientas de presupuesto, atención al cliente en aplicaciones financieras, recursos de educación financiera, plataformas seguras de finanzas personales).

Soporte Al Cliente

En lo que respecta a la atención al cliente, tanto Quicken como Mint se esfuerzan por ofrecer a sus usuarios una asistencia satisfactoria para cualquier problema que puedan encontrar. Sin embargo, existen algunas diferencias en el nivel y los tipos de asistencia que ofrece cada plataforma. Quicken ofrece varias vías de atención al cliente, asegurando que los usuarios tengan múltiples opciones para buscar ayuda cuando la necesiten.

Su sitio web ofrece una extensa base de conocimientos con artículos y preguntas frecuentes que cubren una amplia gama de temas. Además, Quicken ofrece asistencia telefónica en un horario específico para sus usuarios de pago.

Esto permite a las personas hablar directamente con un representante que puede ofrecer orientación personalizada y soluciones adaptadas a sus necesidades. Además, Quicken cuenta con un activo foro comunitario de usuarios en el que los miembros pueden interactuar entre sí, compartir experiencias, plantear preguntas y encontrar soluciones a través de la ayuda entre iguales.

Por otro lado, Mint se basa principalmente en sus recursos en línea para la atención al cliente. Su sitio web incluye una completa sección de preguntas frecuentes que aborda las dudas más comunes sobre las funciones de Mint, las herramientas de presupuesto, el seguimiento de las inversiones y las soluciones de gestión de facturas.

También tienen un blog que cubre varios temas financieros y proporciona consejos para una gestión eficaz del dinero. Sin embargo, a diferencia de la opción de soporte telefónico de Quicken, Mint no ofrece asistencia telefónica directa ni chat en vivo para la resolución inmediata de problemas.

Además, ambas plataformas reconocen la importancia de los recursos de educación financiera para ayudar a los particulares a tomar mejores decisiones sobre sus finanzas personales. Quicken ofrece artículos informativos sobre planificación financiera para particulares dentro de su sección de base de conocimientos.

Por el contrario, aunque Mint carece de contenido educativo específico en su sitio web directamente relacionado con la planificación financiera o las funciones de seguridad per se, ya que se centra principalmente en herramientas presupuestarias y de gestión de las finanzas personales, anima a los usuarios a explorar recursos externos como foros de finanzas personales o a buscar asesoramiento de fuentes acreditadas. Quicken adopta un enfoque más interactivo en la atención al cliente, ofreciendo asistencia telefónica junto con su base de conocimientos y el foro de la comunidad de usuarios.

Por otro lado, Mint se basa predominantemente en recursos de autoayuda, pero anima a los usuarios a explorar fuentes externas si necesitan más orientación o educación financiera. En última instancia, el nivel de atención al cliente que pueda requerir un usuario podría verse influido por sus necesidades y preferencias individuales, por lo que es crucial tener en cuenta este aspecto a la hora de decidir entre Quicken y Mint.

Integración con otras aplicaciones y servicios

Quicken y Mint, las principales aplicaciones de finanzas personales, son conscientes de la importancia de una integración perfecta con otras aplicaciones y servicios para ofrecer una experiencia de gestión financiera completa. Ambas plataformas ofrecen varias opciones de integración que se adaptan a diferentes necesidades y preferencias.

Quicken se enorgullece de su amplia gama de integraciones de aplicaciones, que permiten a los usuarios conectar sus datos financieros con programas de contabilidad populares como QuickBooks. Esta integración es especialmente beneficiosa para los propietarios de pequeñas empresas que necesitan una sincronización perfecta entre sus finanzas personales y las de su negocio.

Además, Quicken también se integra con plataformas de seguimiento de inversiones como Morningstar y permite a los usuarios importar datos de cuentas de corretaje, por lo que es una excelente opción para aquellos que buscan una gestión financiera integral de la jubilación. Por otro lado, Mint ofrece integraciones que se centran más en las necesidades presupuestarias individuales.

Se conecta sin esfuerzo con numerosas entidades bancarias, permitiendo la sincronización automática de transacciones y saldos. Esta función resulta inestimable para quienes prefieren una aplicación gratuita de presupuestos que ofrezca una visión holística de sus finanzas en un solo lugar.

Además, Mint también se integra con servicios de pago de facturas como Bill.com y permite a los usuarios configurar recordatorios para las fechas de vencimiento, garantizando una gestión de facturas sin complicaciones. Mientras que las integraciones de Quicken se centran más en soluciones de presupuestos empresariales y seguimiento de inversiones, Mint se centra principalmente en la planificación financiera individual.

Sin embargo, es importante señalar que ambas plataformas permiten la integración de la aplicación móvil de presupuestos a través de sus respectivas aplicaciones móviles. Esto permite a los usuarios acceder cómodamente a sus datos financieros sobre la marcha y mantenerse actualizados en tiempo real.

La atención al cliente es otro aspecto crucial a la hora de evaluar la integración de aplicaciones. Quicken brilla en este ámbito al ofrecer sólidos servicios de atención al cliente a través de diversos canales, como la asistencia telefónica y la participación activa en foros de finanzas personales.

Por el contrario, mientras que Mint ofrece atención al cliente por correo electrónico o a través de su sección de centro de ayuda en el sitio web, pero carece de soporte telefónico directo. A pesar de algunas diferencias en su enfoque hacia las opciones de integración basadas en las necesidades del usuario, tanto Quicken como Mint destacan por ofrecer integraciones de aplicaciones sin problemas.

Quicken se centra más en la elaboración de presupuestos empresariales y el seguimiento de inversiones con integraciones como QuickBooks y Morningstar, mientras que Mint da prioridad a la planificación financiera individual mediante la integración con entidades bancarias y servicios de pago de facturas. Independientemente de la plataforma que elijan los usuarios, pueden estar seguros de que estas aplicaciones de finanzas personales mejorarán su experiencia de gestión financiera gracias a sus amplias capacidades de integración.

Ventajas e inconvenientes

A la hora de comparar Quicken y Mint, es esencial examinar los pros y los contras de cada plataforma. Ambas aplicaciones ofrecen una serie de características que pueden manejar con eficacia la gestión de las finanzas personales, pero también tienen sus puntos fuertes y débiles. Empezando por Mint, una de sus ventajas más significativas es que es una aplicación de presupuestos gratuita.

Esto la convierte en una opción accesible para las personas que quieren tomar el control de sus finanzas sin costes adicionales. Mint también destaca por ofrecer a los usuarios una visión global de su situación financiera al agregar automáticamente todas las cuentas bancarias, tarjetas de crédito, préstamos e inversiones en una sola plataforma.

Su interfaz fácil de usar permite una navegación sencilla, por lo que es ideal para principiantes o para quienes prefieren la sencillez en sus herramientas de gestión financiera. Sin embargo, el uso de Mint tiene algunos inconvenientes.

Una preocupación común entre los usuarios es la precisión y fiabilidad de su función de seguimiento de inversiones. Aunque proporciona información básica sobre inversiones, los inversores más avanzados pueden considerar que Mint carece de las herramientas necesarias para realizar análisis en profundidad o gestionar carteras.

Además, aunque Mint ofrece soluciones de gestión de facturas mediante el envío de recordatorios de los próximos pagos y el seguimiento de las fechas de vencimiento de las facturas, algunos usuarios han informado de problemas ocasionales de sincronización con los proveedores de facturas. Por otro lado, Quicken se diferencia por ofrecer un conjunto más completo de herramientas de finanzas personales orientadas a las personas que desean capacidades de planificación financiera más robustas.

Con varios planes de precios disponibles (desde Starter hasta Premier), los usuarios pueden elegir el nivel que mejor se adapte a sus necesidades y presupuesto. La fuerza de Quicken reside en su capacidad para generar informes financieros detallados y perspectivas a través de potentes funciones de análisis de datos - perfecto para aquellos que buscan un análisis más profundo de su salud financiera.

Sin embargo, también hay que tener en cuenta algunas consideraciones a la hora de optar por Quicken. Un inconveniente notable es su coste relativamente más elevado en comparación con aplicaciones gratuitas como Mint.

Algunos usuarios pueden encontrar esta estructura de precios menos atractiva o adecuada para sus necesidades si sólo buscan capacidades básicas de presupuestación sin las funciones avanzadas adicionales que ofrecen las versiones premium de Quicken. Otra posible preocupación es el soporte al cliente, ya que algunos usuarios han informado de experiencias dispares con el equipo de soporte de Quicken en términos de tiempo de respuesta y resolución de problemas.

Elegir entre Quicken y Mint depende en gran medida de los objetivos financieros, las preferencias y el presupuesto de cada persona. Mientras que Mint ofrece una plataforma gratuita y fácil de usar con herramientas básicas de presupuestación y soluciones de gestión de facturas, Quicken proporciona un conjunto más robusto de características para la planificación financiera avanzada, incluyendo el seguimiento de las inversiones y la presentación de informes detallados.

Considerar cuidadosamente los pros y los contras de cada plataforma ayudará a los usuarios a tomar una decisión informada basada en sus necesidades específicas de plataformas seguras de finanzas personales. Los comentarios de los usuarios también pueden proporcionar información valiosa sobre las experiencias que otros han tenido con estas aplicaciones para ayudar aún más en el proceso de toma de decisiones.

Opiniones y testimonios de usuarios

A la hora de tomar una decisión sobre plataformas de gestión de finanzas personales como Quicken y Mint, las reseñas y los testimonios de los usuarios desempeñan un papel importante en nuestra comprensión de los productos.

Al conocer la opinión de usuarios reales, podemos calibrar los puntos fuertes y débiles y la experiencia general que ofrece cada plataforma. Profundicemos en las opiniones y testimonios de los usuarios de Quicken y Mint.

Empezando por Quicken, los usuarios suelen destacar sus sólidas funciones para el seguimiento de inversiones y la gestión financiera de la jubilación. Aprecian las completas herramientas que les permiten supervisar sus carteras, realizar un seguimiento de acciones, bonos, fondos de inversión y mucho más.

Además, muchos usuarios consideran que las herramientas presupuestarias de Quicken son muy útiles para gestionar sus finanzas de forma eficaz. La posibilidad de crear presupuestos personalizados basados en diversas categorías permite a los usuarios controlar sus hábitos de gasto.

Sin embargo, cabe señalar que algunos usuarios consideran que los precios de Quicken son más elevados que los de otras aplicaciones de finanzas personales disponibles en el mercado. Algunos han expresado que se sienten restringidos por ciertas características que se limitan a niveles de precios específicos.

En cambio, Mint recibe grandes elogios por ser una aplicación gratuita de presupuestos con una interfaz de usuario intuitiva. Los usuarios aprecian su sencillez a la hora de configurar cuentas de varias instituciones financieras en una sola plataforma para facilitar el seguimiento.

Las herramientas presupuestarias de Mint suelen ser elogiadas por su eficacia a la hora de ayudar a las personas a adquirir el control financiero, ya que proporcionan representaciones visuales de los hábitos de gasto y ofrecen recursos de educación financiera personalizados. Aunque Mint ofrece muchas ventajas como aplicación gratuita, hay algunas limitaciones que los usuarios señalan en comparación con Quicken u otras plataformas de pago.

Algunos usuarios mencionan que echan de menos ciertas funciones avanzadas que se encuentran en las alternativas de pago o que desean más opciones de personalización dentro de la aplicación. En general, mientras que ambas plataformas reciben comentarios positivos de los usuarios en foros de finanzas personales y plataformas de revisión por igual, las preferencias individuales jugarán un papel importante en la determinación de cuál es el más adecuado para las necesidades específicas.

En última instancia, todo se reduce a factores como el precio, la necesidad de funciones avanzadas y las preferencias personales en cuanto a la interfaz de usuario y la integración de aplicaciones. Las opiniones y los testimonios de los usuarios son recursos valiosos para entender los puntos fuertes y débiles de Quicken y Mint.

Ofrecen información sobre diversos aspectos, como informes y datos financieros, herramientas presupuestarias, funciones de seguimiento de inversiones, características de seguridad, experiencias de atención al cliente y mucho más. Teniendo en cuenta estas experiencias reales compartidas por los usuarios, las personas pueden tomar decisiones informadas sobre qué plataforma se alinea mejor con sus objetivos y preferencias financieras.

¿Quién debe utilizar qué plataforma?

Determinar qué plataforma, Quicken o Mint, se adapta mejor a tus necesidades financieras depende de varios factores. Ambas plataformas ofrecen características únicas y se dirigen a distintos tipos de usuarios. Profundicemos en quién debería usar cada plataforma para tomar una decisión informada.

Quicken, con sus sólidas funciones y su completo software de gestión financiera, es una opción adecuada para las personas que necesitan herramientas presupuestarias avanzadas y desean un mayor control de sus finanzas. Si es usted propietario de una empresa y busca soluciones de presupuestación empresarial o alguien que requiere un seguimiento en profundidad de las inversiones y una gestión financiera de la jubilación, Quicken le ofrece una amplia gama de opciones.

Sus planes de precios incluyen Starter, Deluxe, Premier y Home & Business, que se adaptan a distintas necesidades y presupuestos. Por otro lado, Mint atrae a los usuarios que prefieren una aplicación de presupuestos gratuita que ofrezca funciones básicas para la gestión de las finanzas personales.

Si buscas una forma sencilla de controlar tus gastos y supervisar tu salud financiera general sin necesidad de realizar un seguimiento complejo de las inversiones o de herramientas de elaboración de informes exhaustivas, Mint puede ser una opción excelente. Además, la integración de Mint con varias aplicaciones móviles de presupuestos y otras plataformas financieras permite a los usuarios tener una visión consolidada de sus finanzas en un solo lugar.

En lo que respecta a la atención al cliente de las aplicaciones financieras, tanto Quicken como Mint ofrecen asistencia a través de distintos canales, como el correo electrónico o los foros en línea. Sin embargo, Quicken ofrece asistencia telefónica, así como acceso a una amplia comunidad de usuarios que pueden proporcionar valiosas ideas y orientación basadas en sus experiencias con el software.

En última instancia, la decisión entre Quicken y Mint se reduce a sus necesidades y preferencias específicas. Considere factores como la complejidad de su situación financiera, el nivel de control que desea sobre sus finanzas, si necesita funciones orientadas a los negocios o herramientas sencillas de gestión de las finanzas personales.

Ten en cuenta las opiniones de los usuarios sobre el amplio conjunto de funciones de Quicken frente a la comodidad que ofrece la aplicación gratuita de presupuestos Mint. Analiza bien los pros y los contras antes de tomar una decisión que se ajuste a tus objetivos financieros a largo plazo y valore las funciones de seguridad financiera.

Casos prácticos

A la hora de elegir entre Quicken y Mint, comprender los distintos casos hipotéticos puede ayudarle a determinar qué plataforma se adapta mejor a sus necesidades específicas. Tanto si eres un particular que busca ayuda para la planificación financiera personal como si eres el propietario de una empresa que busca soluciones presupuestarias eficientes, la evaluación de estos casos prácticos puede proporcionarte información valiosa.

En primer lugar, consideremos el caso de un particular que busca herramientas completas de planificación financiera. Quicken ofrece una serie de funciones que responden a esta necesidad específica.

Gracias a sus sólidas herramientas de presupuestación y a sus amplias funciones de seguimiento de inversiones, Quicken permite a los usuarios crear presupuestos personalizados, realizar un seguimiento de los gastos y gestionar las inversiones de forma eficaz. Además, los informes financieros de Quicken proporcionan a los usuarios información detallada sobre su situación financiera, lo que les ayuda a tomar decisiones con conocimiento de causa.

Para quienes valoran el análisis detallado y el control de sus finanzas tanto a nivel personal como de inversión, Quicken resulta ser una opción potente. Por otro lado, si eres un particular que busca una aplicación gratuita de presupuestos que ofrezca funciones básicas de gestión financiera sin necesidad de una gran personalización o seguimiento de las inversiones, Mint puede ser la opción adecuada para ti.

La interfaz fácil de usar de Mint hace que sea accesible para las personas que prefieren la simplicidad en la gestión de sus finanzas. Ofrece herramientas presupuestarias básicas, como la categorización de gastos y la supervisión de transacciones, que pueden ayudar a los usuarios a controlar sus hábitos de gasto sin esfuerzo.

Teniendo en cuenta otro escenario en el que las empresas buscan soluciones eficaces de gestión de facturas combinadas con integraciones con otras aplicaciones/servicios cruciales para sus operaciones, Quicken se perfila como la opción más adecuada en comparación con Mint. Con sus funciones específicas para empresas e integraciones con varias plataformas de software de contabilidad como QuickBooks, Quicken ofrece una mayor flexibilidad para gestionar los gastos de la empresa de forma eficiente.

Basándonos en estos casos, queda claro que la elección entre Quicken y Mint depende de sus necesidades individuales. Para las personas que buscan soluciones integrales de gestión de finanzas personales con funciones avanzadas y sofisticadas capacidades de análisis adaptadas a las necesidades de inversión y presupuestación, Quicken destaca como la opción preferida.

Por otro lado, Mint atrae a quienes buscan una aplicación presupuestaria simplificada y gratuita con herramientas básicas de gestión financiera. Comprender tus necesidades específicas y evaluar las características que ofrece cada plataforma te ayudará a tomar una decisión informada.

Conclusión

Tanto Quicken como Mint ofrecen características y funcionalidades excepcionales que se adaptan a las diferentes necesidades de los usuarios. Quicken destaca por sus sólidas herramientas de planificación financiera, sus funciones de seguimiento de inversiones y sus completas soluciones de gestión de facturas. Sus distintos planes de precios permiten a los usuarios elegir el que mejor se adapte a su presupuesto y necesidades.

Además, la integración con otras aplicaciones y servicios mejora aún más su usabilidad. Por otro lado, Mint destaca por ofrecer una experiencia fácil de usar gracias a su interfaz intuitiva y su aplicación móvil de presupuestos.

Ofrece una amplia gama de herramientas presupuestarias que permiten a las personas hacer un seguimiento de sus gastos, establecer objetivos de ahorro y gestionar sus finanzas de forma eficaz. Además, los recursos de educación financiera de Mint proporcionan información valiosa sobre la gestión de las finanzas personales.

Aunque ambas plataformas tienen sus puntos fuertes, es importante tener en cuenta las preferencias individuales a la hora de elegir entre Quicken y Mint. Los que buscan una solución financiera de nivel profesional con funciones avanzadas pueden encontrar Quicken más adecuado para sus necesidades.

Por otro lado, las personas que buscan una herramienta presupuestaria simplificada pero eficaz y de fácil acceso podrían preferir Mint. Independientemente de la elección que se haga, es innegable que ambas plataformas han contribuido significativamente a revolucionar la gestión de las finanzas personales.

Con plataformas seguras que ofrecen diversas funciones de seguridad financiera, como el cifrado y la autenticación multifactor, los usuarios pueden sentirse seguros al gestionar sus finanzas en línea. Tanto si es usted un particular que busca mejorar su competencias presupuestarias o un empresario que busca soluciones eficaces de gestión financiera, Quicken frente a Mint le ofrece opciones que pueden satisfacer sus necesidades de forma eficaz.

Los pros y los contras de cada una de ellas, junto con los comentarios de usuarios satisfechos que han utilizado con éxito estas plataformas para el seguimiento de sus inversiones o la gestión de sus facturas, le ayudarán a elegir la que mejor se adapte a sus necesidades. Adopte estas herramientas innovadoras, ya que allanan el camino hacia una mejor planificación financiera y un futuro más brillante de estabilidad monetaria.